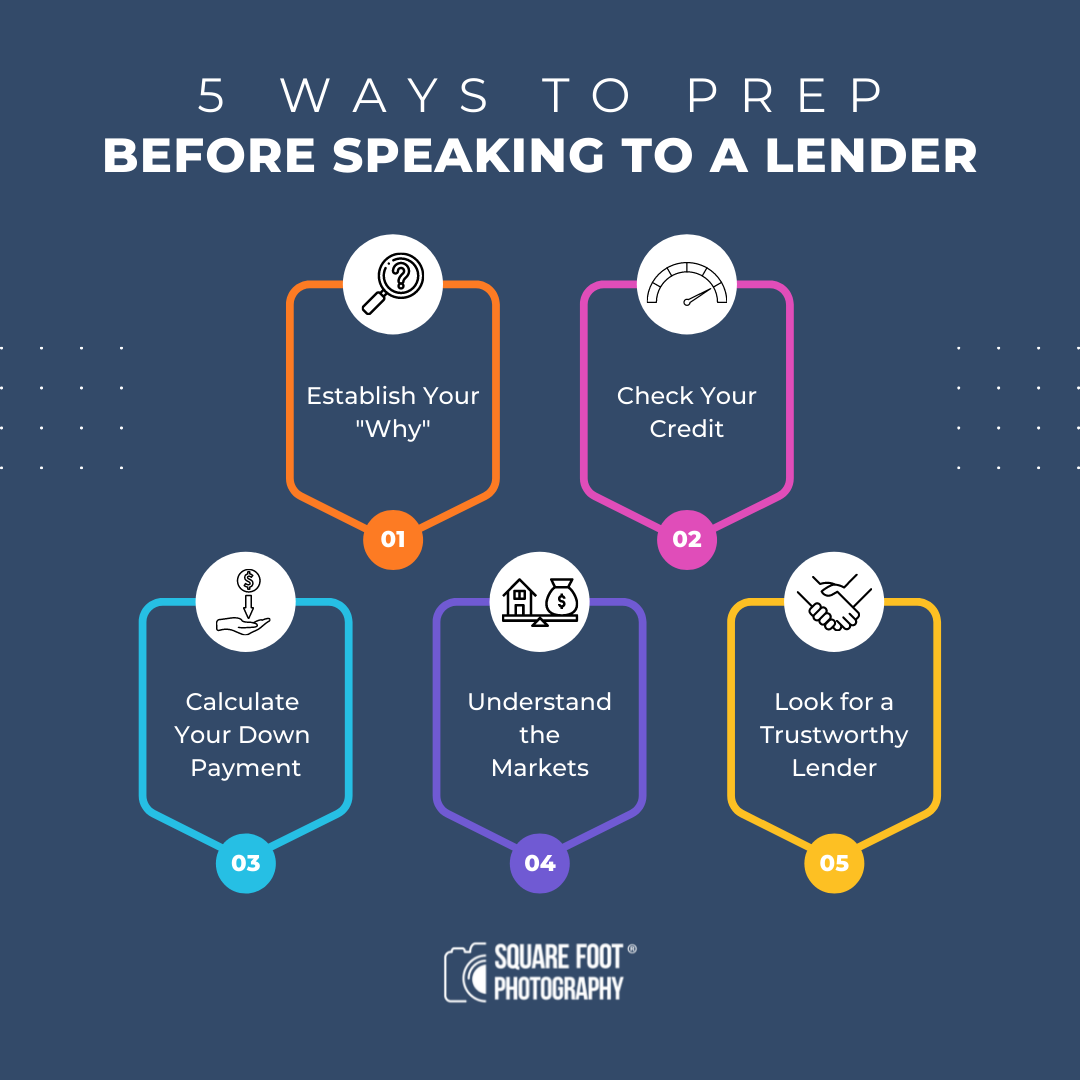

Ask a Mortgage Lender: 5 Ways a Buyer Can Prepare

Buyer agents know that their time spent looking for homes should be with qualified buyers. Many agents request potential clients get pre-qualified before going on any tours with them. Rather than just recommending some lenders and waiting for their pre-qualification letter, use this opportunity to show you are a valuable resource by sharing some tips for starting the lending process. Josh Hiller, Senior Loan Officer and Team Manager with JB Mortgage Group, told us all about how a potential buyer can best prepare. Read on for five ways your clients can get all their ducks in a row before speaking with a mortgage lender.

Establish the WHY

Most people start looking to buy a home because something has changed in their current situation. Maybe their family is growing or maybe they got a new job across town. Josh Hiller says it’s important to first establish the primary reason, or reasons, for buying a home. This provides a good anchor to keep the buyer grounded in all their decisions. Check in at each stage of the home buying process to ensure their “why” will be achieved.

Check Credit Scores

Josh recommends each adult involved in the transaction check their credit scores before having a lender run their credit. Any credit issues that come up can then be addressed and improved before they start their home search, setting the buyer up for a better mortgage option. Some credit issues aren’t as easy to resolve but it’s part of the lender’s job to, as Josh says, “[help] polish the prospective buyer and turn them into a capable buyer.”

Calculate a Down Payment

Is the potential buyer currently a homeowner with equity, a renter with consistent payment history, or neither? What it boils down to for Josh is this – “What do you have available for a down payment?” That number will determine the amount of house the buyer can afford and help in finding the right loan for their financial situation. A lender can review the eligible options and advise on the best choice to meet the potential buyer’s goals.

Understand the Housing & Lending Markets

It’s the real estate agent’s duty to be familiar with the housing market(s) they do business in. The most successful agents help their buyer clients understand the current market conditions and how it affects their homebuying journey. It’s the lender’s job to explain the lending market and how it can affect the life of the buyer’s loan. Just remember, no one is capable of predicting the future or promising specific outcomes.

Look for a Trustworthy Lender

Buying a home is often a potential buyer’s largest-ever purchase at the time. Josh believes it’s best to look for a lender who will serve their best interests and make the process as stress-free as possible. He says that while not all lenders charge the same fees, quality and trustworthy service win over savings any day. JB Mortgage Group embodies this with a community-first philosophy – they’re in tune with their community’s needs because they live there, too.

Purchasing a home, and taking on a loan in the process, is a huge step for most homebuyers. They look to their real estate agent for guidance and to stay on track, catching loose ends along the way. Having a good relationship with local lenders is key for to helping clients at every stage in the home-buying process. They’re there to help where you can’t, as it’s important to never step outside your ethical bounds as an agent. Let’s leave the lending to them, and when in doubt, ask a mortgage lender! What you can do is download our fun infographic (see above), and share it with your clients and social media followers to help them get mortgage-ready.